Africana Studies, 1969-2019: A History of Imagining Otherwise

An exhibition at the Vassar College Library marking the 50th anniversary of the Africana Studies Program at Vassar College.

September 19 through December 22, 2019.

Vassar Scholarship, the institutional repository formerly known as Digital Window, reflects the research and scholarly output of the Vassar College community. It provides access to a variety of collections, including senior theses and projects across a wide range of disciplines.

An exhibition at the Vassar College Library marking the 50th anniversary of the Africana Studies Program at Vassar College.

September 19 through December 22, 2019.

There are numerous examples of assets with identical payout streams being priced differently. These violations of the law of one price result from two factors. First, investors have heterogeneous asset valuations so that if two groups of investors trade in...

Basketball is considered a revenue sport within the context of the National Collegiate Athletic Association (NCAA). The annual March Madness tournament brings in over a billion dollars in advertising revenue alone. This is just one illustration of the influx of...

Shakespeare at Vassar was organized by the Vassar College Special Collections Library, in collaboration with The Frances Lehman Loeb Art Center, with funds from the Hartman Fund Layout and typography by George Laws, and print production oversight by Daniel Lasecki...

I present a model that can transform discounts on closed-end mutual funds into a measure of investor sentiment about the ability of fund managers to beat the market. This measure of sentiment varies positively with capital flows into actively managed...

The Archives & Special Collections Library is part of the Vassar College Libraries system. It holds the rare book, manuscript, and archival collections of the college. It collects, preserves, and makes available rare and unique collections, and also engages in teaching and outreach activities. This collection of finding aids describe items in both the Virginia B. Smith Memorial Manuscript Collection and the College Archives.

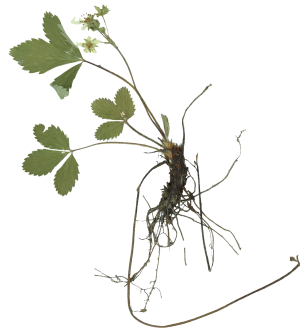

The Vassar College herbarium holds over 8,000 specimens of vascular plants, bryophytes, and algae. Holdings are primarily from northeastern North America, and include collections made by several notable 19th century botanists. To learn more about this project visit the website here.

Vassar College's institutional repository reflects the research and scholarly output of the Vassar College community. It provides access to senior theses, peer reviewed open access articles, and projects from a wide range of disciplines.