Browse Our Collections

Available collections

Finding Aids

Finding Aids

The Archives & Special Collections Library is part of the Vassar College Libraries system. It holds the rare book, manuscript, and archival collections of the college. It collects, preserves, and makes available rare and unique collections, and also engages in teaching and outreach activities. This collection of finding aids describe items in both the Virginia B. Smith Memorial Manuscript Collection and the College Archives.

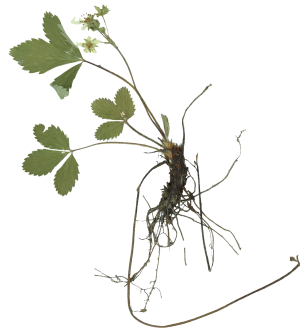

Herbarium

Herbarium

Image

The Vassar College herbarium holds over 8,000 specimens of vascular plants, bryophytes, and algae. Holdings are primarily from northeastern North America, and include collections made by several notable 19th century botanists. To learn more about this project visit the website here.

Vassar Scholarship

Vassar Scholarship

Vassar College's institutional repository reflects the research and scholarly output of the Vassar College community. It provides access to senior theses, peer reviewed open access articles, and projects from a wide range of disciplines.